Amicus conducts updates every six month of its clients’ investment performance against peer averages. The background to our methodologies used can be found in our previous article “Peer Comparisons Show Value of Advice” published in August 2018.

Our latest survey for the six months ending December 2018 showed Amicus clients achieving an average return of 103bps over the Bloomberg Bank Bill Index benchmark as compared with non-Amicus clients (those either advised by others or without advisors) achieving an average return of 88bps over benchmark. This is an average value add of over 13 times the fees Amicus charges for advice as measured by average additional returns in dollar terms divided by average Amicus fees.

Generally, these additional returns come with little or no additional risk because they are due to the implementation of a strategy appropriate to the prevailing market environment and better timing and execution regarding the purchase of investments. For instance, Amicus strongly recommended the recent ANZ 5 Year FRN that was issued at a margin of 110bps over the BBSW rate with a first coupon yield above 3%. This investment was enhancing to most conservative investors’ portfolios and the margin on this FRN has now contracted to under 100bps in the secondary market. On the risk side the issuer, ANZ, is a major bank which likely has a lower risk of default when compared with regional banks, building societies, credit unions or other ADI’s within Australia and therefore the risk vs reward trade-off at the time of purchase was superior to other investments available.

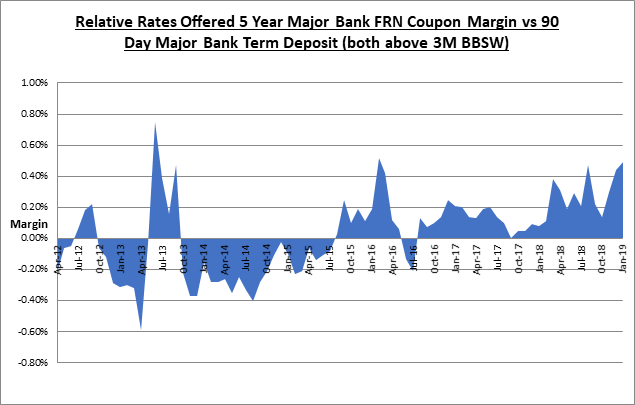

The graph above shows FRN rates relative to TD rates over the last 7 years (sourced from Amicus database). There are periods when FRNs have offered the best returns and periods when Term Deposits have offered the best returns. By advising clients when to invest in which instrument has been a large source of value add and is one of many reasons for Amicus clients’ out-performance relative to peers.