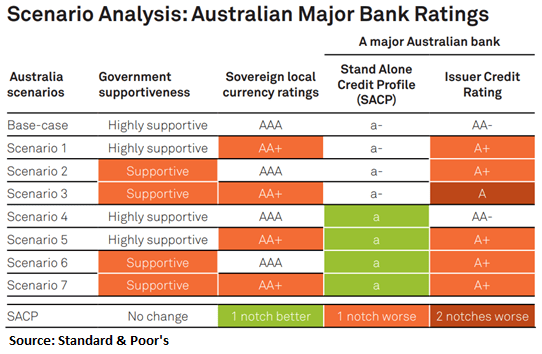

In early April, S&P Ratings Agency stated over the next two years there is a one in three chance it will cut its assessment of the Australian government’s support of the major banks in a financial crisis. If the Australian government’s supportiveness assessment reduces to “supportive” from “highly supportive” the major banks’ credit ratings will be consequently lowered by one notch to A+ from AA- as seen in Scenario 2 in the chart below.

To expand on S&P’s ratings of banks, S&P (and the other major credit ratings agencies) work on the basis of an “anchor” that defines the Banking Industry Country Risk Assessment (BICRA) in which the bank operates that takes into account economic and industry risks. The next step for S&P from this BICRA anchor is to look at various broad factors that affect the bank’s creditworthiness being its business position in its market, capital position and earnings capacity (profitability), risk position (how risky are its assets and lending), funding and liquidity. These are then used to increase or decrease its BICRA anchor rating depending on whether they are strengths or weaknesses. This produces what S&P terms the bank’s stand-alone credit profile (SACP). Finally, if the bank has a degree of additional support for its ratings from the government or from a more creditworthy parent entity this is considered.

S&P assigns an anchor rating of “BBB+” to the Australian banks as they predominantly operate in Australia which is considered a stable and relatively low risk environment. The four majors then get a one notch uplift because of their strong business position, which results in the bank’s stand-alone credit profile of “A-”. All other aspects (capital and earnings, risk position, funding and liquidity) are considered neutral by S&P. The banks then get a three-notch uplift for “sovereign support” resulting in the major banks’ issuer credit rating of AA-.

As per the table above, S&P’s base case is “the Australian government will remain highly supportive toward the systemically important private sector banks…At the same time, we see some ambiguity in future policy direction on this matter. Consequently, we have our ratings on the Australian major banks on negative outlooks reflecting our most likely alternative scenario–which we consider has a one-in-three chance of occurring over the next two years – that the Australian government supportiveness will diminish to supportive from highly supportive.”

S&P currently rates the major banks as AA-/A-1+ with the outlook remaining negative until “we [S&P] gain sufficient clarity on the future of the bank resolution framework, including the TLAC [total loss absorbing capacity] framework” that was proposed by APRA late last year.

For clarity, the change of supportiveness of the major banks is not being driven by a change in sentiment by the government (or political views i.e. whether Labour or the Coalition are in government), but by the implementation of global banking rules that will make it harder for the government to intervene. This change originating in Europe (including the UK) where in the GFC many governments bailed out their banks with public funds. The governments felt they had little choice, but the populace was generally very angry at the perceived injustice that bankers made large profits in good times, but tax payers paid to support them in a crisis so the policy reaction was to make banks hold more capital and make investors in bank preference shares, subordinated debt and senior bonds take more risk as governments withdrew support. These are global rules with local implementation so S&P is waiting for greater clarity from APRA, the local regulator, as to the exact form of implementation.

The key implication of a downgrade of the Australian Majors’ credit rating is in client investment policies that usually specify a certain percentage of assets must be held in assets rated AA- or higher. Some clients may therefore breach of their policies if a downgrade were to occur, particularly when all four major banks are downgraded together in lock-step, which is the likely outcome. It is part of Amicus’ service to review client investment policies on a regular basis and we are more than willing to help investors manage for this particular risk as we see it as real and apparent, if not imminent.