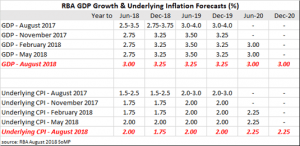

The RBA’s quarterly statement on monetary policy was released in early August with the comments “The forecasts for global and domestic growth are little changed from those presented in the May Statement on Monetary Policy”(SoMP). Amicus regards this forecast (as seen below) as a somewhat “political document” as the RBA essentially needs to show key variables of GDP growth and CPI within their target boundaries in the longer term otherwise the obvious question asked is why does the RBA not adjust policy settings now to move these variables closer towards the target zones as this is its mandate? Despite this flaw, the forecast is useful in terms of revealing changes in the RBA’s expectation of these key variables from quarter to quarter.

The SoMP predictions were supported by the Westpac and Melbourne Institute Leading Index which showed growth above trend of 0.55% in July up from -0.06% in June. Trend growth is estimated to be around 2.75% (reduced from a previous figure of 3.00% over the last few years). This would place GDP growth at around 3.25% for December 2018, consistent with the SoMP. In early September, the official GDP figures were announced showing growth of 3.4%, validating the index as an effective leading indicator.

Commenting on the figures, Westpac’s chief economist, Bill Evans said the drags on the index were an increased fear of unemployment, lower commodity prices and a flatter yield curve. Evans, who is generally bearish and pessimistic about the economic outlook amongst his economist peers, believes going forward growth will fall below trend due to falling confidence (both business and consumer), a slowdown in jobs growth and the high level of household debt combined with lower property prices. Evans is forecasting no increase in the RBA cash rate until 2020.